FIX YOUR CREDIT & FUND YOUR DREAMS WITH Classe Credit Academy

I'll Teach you LIVE on Zoom, The SIMPLE Way To Fix Your Credit !

Results in the first 7-30 days of Deletions & Score Boost.

Average full repair time takes about 3-5 months .

$37 ONLY

ABOUT US

Classe Consulting LLC Is More Than a Service… It’s a COMMUNITY!

Strong credit isn’t optional, it’s essential.

Our credit coaching goes far beyond reports and scores. We’re a dedicated community committed to helping you take control of your finances, build reliable credit habits, and open the doors to true financial independence.

This isn’t just about repairing credit. It’s about mastering the financial principles that help you break free from the rat race and approach wealth-building the way it’s truly meant to be done.

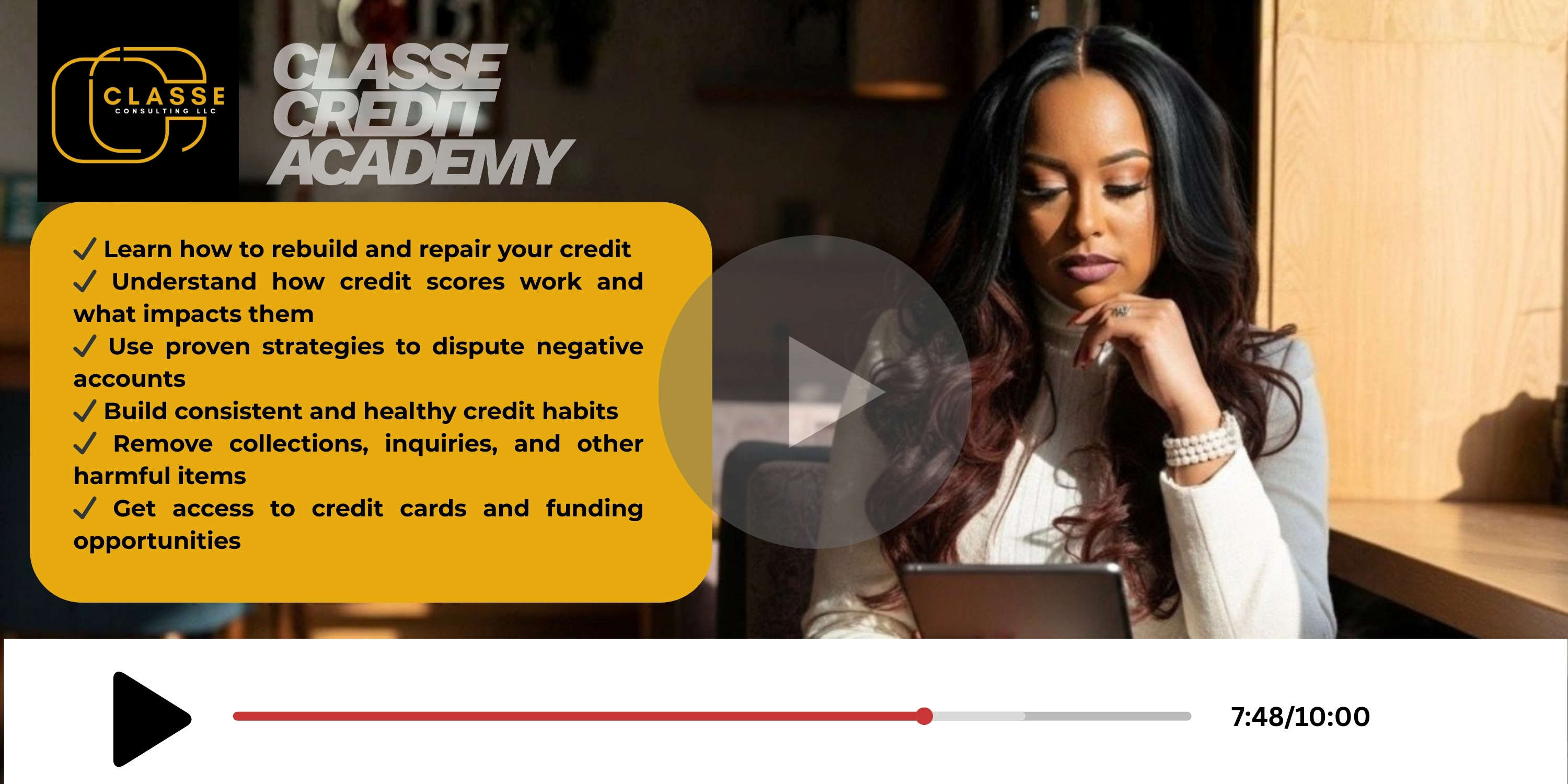

HERE ARE JUST A FEW THINGS YOU WILL LEARN INSIDE THIS COMMUNITY

SEE RESULTS IN the First 7-30 DAYS

– Discover how to remove late payments, repossessions, charge-offs, inquiries, and more.

– Learn how to secure high-limit credit cards.

– Guidance for home buying & auto loan approval.

– Business credit building in 90 days (all letters and digital guides included with your enrollment).

LIVE Zoom Classes Every Tuesday @ 7:30 PM Central

(All sessions are recorded for replay.)

– Classe Consulting will review your credit report 1-on-1:

– We’ll walk through your entire credit report together, you never have to figure this out alone.

– Learn exactly how to read, analyze, and dispute negative accounts.

– You’ll see how to create your own letters and get access to credit-building tools to help increase your scores.

EXCLUSIVE: Private Community Chat

– Ask questions in real time and get support directly from our team.

– Share your wins and watch how other members are transforming their credit step-by-step.

ALL Credit Repair Templates Included + 7-Day Deletion Kit

Join today and get immediate access to every credit repair template and dispute letter, resources that normally cost thousands and have successfully removed hundreds of negative items.

NEW METHOD: Remove Late Payments in as Fast as 7 Days

We break down our exact process for fast late-payment deletion, a strategy most credit companies never reveal because it’s new, current, and highly effective.

24-HOUR Inquiry Removal Strategy

Most companies charge $50 per inquiry to do what you’ll learn on day one. You can also use this method to provide the service to others if you choose.

HOW TO STRUCTURE YOUR BUSINESS FOR MAX FUNDING

Many believe a 700+ score automatically brings $500k in funding, but that’s not how lenders work. We’ll show you the correct structure that truly matters so you can position your business for substantial funding opportunities.

FULL ACCESS TO Every Ebook, Template & Course We’ve Created

Start your financial literacy journey with Classe Consulting LLC and unlock our complete collection of premium trainings, normally sold for thousands, available to you instantly when you join.

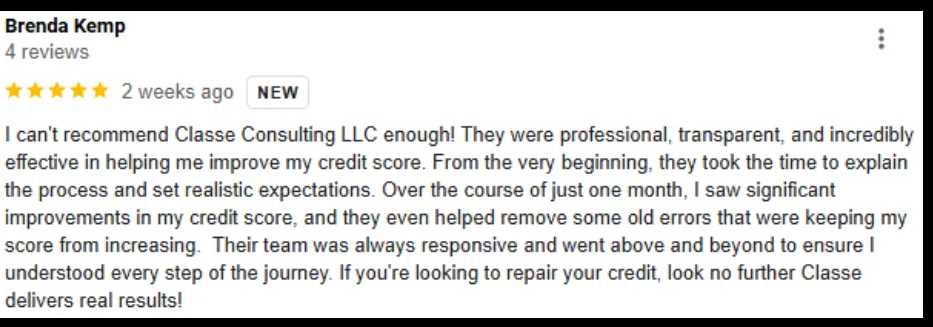

Here are a few results our students have proudly shared with us.

FREQUENTLY ASKED QUESTIONS

How do I know this company is legitimate and not a scam?

We understand that the industry is often filled with scammers and empty promises. That’s why we are committed to making Classe Credit Consulting (CCC) as transparent as possible. While we could proudly tell you all day long that CCC is the best, that won’t mean much unless you experience it for yourself. The most effective step you can take is to conduct thorough research about us. We’re featured on several platforms, including Google, BBB, Yelp, and Facebook. We have countless testimonials from clients who, like you, were initially skeptical but took a chance that ultimately transformed their lives. It’s crucial that you place your trust in us and our process to get the most out of our program.

How long does it take before I can expect to see results?

Our objective is to grow your credit score through credit restoration and rebuilding. By following our guidance, you may see improvements within a month. However, fully restoring your credit takes time, and we suggest allowing 6 months to a year to achieve the best results for optimizing your credit profile.

How long will it take to obtain 700 credit score?

No one can predict exactly how many points your score will increase or provide a specific timeline, as the FICO scoring model considers several factors in calculating your credit score using an algorithm. While we can’t guarantee a precise timeframe, we can assure you that by following our advice, managing your credit responsibly, and staying patient and consistent, you can achieve a 700 credit score.

Once an item is removed from my credit report, can it reappear at a later date?

Our approach to challenging Metro2 Compliance is rooted in the Fair Credit Reporting Act. Legally, credit bureaus are prohibited from reinserting an account once it has been removed, unless the creditor has provided the bureau with validation supporting its continued presence on your credit report (which is uncommon), or the debt was sold to another collection agency, and the new agency reports it under a different account number. If your debt is sold, there’s no need to worry—you can dispute it again to have it removed.